Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Precious metals, such as gold and silver, are much more than just shiny and pretty. They are quite valuable, and many signs indicate that they will continue to grow in value in the future. Adding precious metals to your portfolio allows you to diversify your portfolio by removing some of your money from the stock market and protecting yourself against stock market volatility.

JM Bullion is one of the many precious metals investment companies out there. In the next few sections, we'll share important information about the company, the products and services they offer, and the experiences other customers have had. Read on to decide if JM Bullion is the right precious metals company for you to work with.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if JM Bullion made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About JM Bullion

JM Bullion was founded by Michael Whittmeyer and Jonathan Wanchalk in 2011. Over the last decade, they have grown quickly to become a well-known name in the precious metals investment industry. In fact, they have even been identified as one of the fastest growing precious metals companies on the Inc. 500.

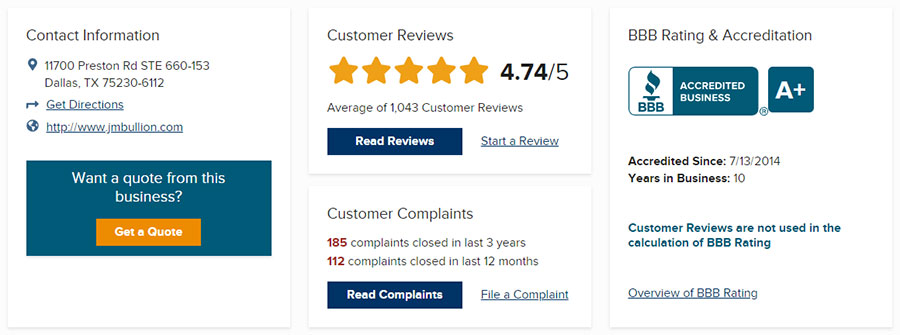

JM Bullion's website identifies customer service as one of the areas they are most proud of. Customer service representatives are available via chat, email, or phone. The company has earned an A+ rating from the Better Business Bureau and is a BBB Accredited Business.

JM Bullion also works hard to keep their customer's person information secure. They use 256-bit SSL encryption to ensure credit card numbers and other identifying information is protected. Additionally, when orders are shipped, they are discretely packaged to prevent others from knowing what is being delivered.

Shipping and Insurance

Orders over $199 ship for free. Smaller orders are charged a negligible fee of $7.99. With the free shipping option, JM Bullion choose the carrier based on the lowest price available, as this allows them to keep their costs down for customers.

In many cases, however, you can pay to upgrade your shipment method to the carrier you prefer. This will result in a higher fee, but it can also provide you with peace of mind if you would prefer your order to be shipped in a particular fashion.

To ensure your privacy and protect the contents of your shipment, orders are discreetly packaged. Everything is also securely packaged and carefully wrapped to ensure it does not become damaged during shipping.

Once orders are placed, you'll be able to track the progress of your order. This will allow you to monitor your shipment and know when to expect it so you can bring it safely into your home.

All orders shipped by JM Bullion are fully insured for transit. In the event your package is lost en route to you or the contents become damaged, you are not liable. JM Bullion will fully refund you or replace the contents. After you have signed for the package, the transit insurance ends, and you have 48 hours to make a claim.

Storage Options

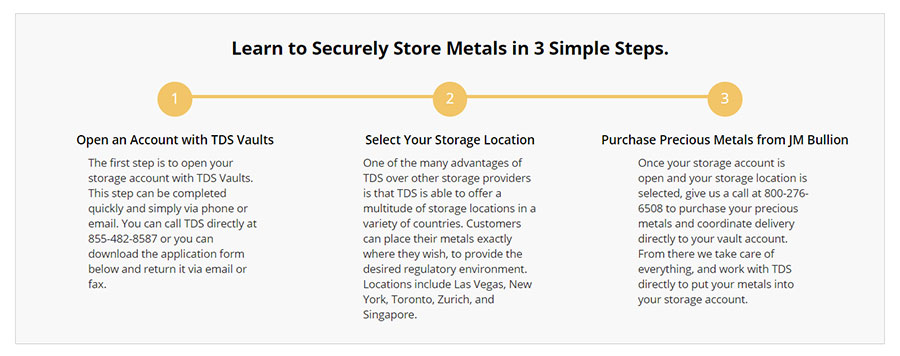

Many individuals choose to have their precious metals shipped to their home. However, others opt to have them stored in a secure storage facility where they will be less likely to be damaged or stolen. When you purchase metals from JM Bullion, you can choose to store your metals with TDS Vaults.

TDS Vaults is a trusted name for precious metals storage. They have storage partners in many locations across the globe, so you'll be able to choose which location is best for you. The available locations include Las Vegas, NV, Toronto, ON, Zurich, and Singapore.

TDS Vaults has been in business since 1965, making them an experienced leader in the storage industry. They offer fully allocated storage, which ensures that your precious metals are stored under your name and kept separate for you. This means you'll get the exact coins and bars you add to storage when you are ready to take them out.

Precious metals stored with TDS Vaults are also double insured. The vault holding them offers insurance and well as the insurance provided by the commercial "all risk" insurance policy they hold. Should anything happen to your metals, you won't need to worry with this insurance.

Investing in Gold

When you're looking to purchase gold, JM Bullion offers a nice selection for you to choose from. Their selection includes gold coins, gold bars, gold jewelry, and gold notes. Below are a few of the options you can choose from. You can view the entire collection on the website.

Coins

Bars

Investing in Silver

Silver is another popular investment. With its growing demand for technology and manufacturing, it is looking like a pretty solid investment. Below you'll find some of the various silver coins, rounds, and bars available through JM Bullion.

Coins

Rounds

Bars

Investing in Platinum

JM Bullion also offers platinum coins and bars. These include:

Coins

Bars

Additional Investment Opportunities

In addition to the gold, silver, and platinum coins and bars offered by JM Bullion, they also offer copper rounds, copper bars, wheat pennies, copper bullets, palladium bars, palladium coins, and a variety of coin and bar accessories. If you're interested in purchasing any paper currency, there are also some different options to choose from including uncirculated 1976 $2 Bicentennial Federal Reserve Notes, $2 Buffalo Legal Tender Notes, $2 9/11 20th Anniversary Statue of Liberty Legal Tender Notes, and 1864 $100 Confederate States of America Notes.

Precious Metals IRAs

Setting up a Precious Metals IRA with JM Bullion is another option to consider if you're looking to diversify your portfolio. A Precious Metals IRA, which is a type of Self-Directed IRA lets you hold gold, silver, and other precious metals in a retirement account. This not only helps you save and prepare for retirement, but it lets you enjoy the tax benefits offered to IRA holders as well.

JM Bullion has partnered with IRA custodians and can help you set up a Precious Metals IRA. The custodian and representative from JM Bullion will work with you to open your account, fund it with a transfer from your bank or an existing retirement account eligible for a rollover, and select the coins and bars you'd like to add. New Direction Trust Company is JM Bullion's preferred IRA custodian to work with. You can also choose to work with Equity Trust, GoldStar Trust, or Strata Trust.

IRS regulations limit the coins and bars that can be held in a Precious Metals IRA. Gold must me 99.5% pure, silver must be 99.9% pure, and platinum and palladium must be 99.95% pure. Within these regulations, there are still a number of coins and bars you can add to your account. You can visit the website to view the full list or IRA-approved gold, silver, platinum, and palladium.

Gold and Silver Loans

If you are in the need for cash, but don't want to sell all of your precious metals, JM Bullion offers an alternative. They have partnered with Collateral Finance Corporation and offer gold and silver loans. A gold and silver loan allows you to use your precious metals as collateral to obtain a loan to get the cash you need to tackle home projects, pay medical bills, afford a family vacation, and more.

Price Alerts

If you're waiting for the price of gold or other precious metals to decrease before making a purchase, you can use the price alerts feature on the website to help you know when is the right time to buy. With this feature, you can set an alert when the price falls below a set number, so you'll be notified and can make a purchase. You can sign in to set up alerts using Facebook, Google+, Windows Live, Apple, or Yahoo.

Are There Any Red Flags for JM Bullion?

Red flags can alert you to the fact that you may not want to do business with a particular company. Looking at reviews from the Better Business Bureau, Business Consumer Alliance, Trustpilot, and TrustLink can help you learn more about a company. These reviews should provide you with insight on how the company does business and treats their customers.

Below are the reviews and ratings for JM Bullion from these various review sites.

Is JM Bullion a Scam?

JM Bullion is not a scam. It is a legitimate company that has been in business since 2011.

However, there are a few reasons you may decide against giving your business to JM Bullion when you're looking to purchase precious metals. While many customers have shared that they are happy with the products and services they received, there are a large number of customers who have expressed dissatisfaction with JM Bullion.

For example, in the past three years, there have been 185 complaints against JM Bullion registered with the Better Business Bureau. These complaints were filed on a variety of topics from advertising to billing to issues with the guarantee or warranty offered by the company. However, the vast majority of the complaints (143 out of the 185 complaints) were about either delivery issues or problems with a product or service.

Many of the negative review center around receiving damaged or non-mint condition products. Customers also expressed dissatisfaction regarding the response they received from JM Bullion and were not pleased with how their complaints were handled.

JM Bullion also received an F rating from the Business Consumer Alliance. This should set off alarm bells that something is not right with the way the company conducts business and may be a reason to stay away from JM Bullion.

Another reason to consider going with a different precious metals company is that JM Bullion does not directly offer Precious Metals IRA. They are offered through IRA custodians that they have partnered with, but not directly through the company as with many other investment companies. One problem with this is that it can be more challenging to assess the setup and maintenance fees that you'll be charged, since it will depend on which custodian company you work with. It may be better to choose to work with a gold investment company that sets up their own IRAs, as the process and fees should be more transparent.

With the hundreds of precious metals investment companies out there, a little research should help you see that you may be better off giving your business to a different company.

Features

Pros:

Cons:

Final Verdict

Investing in precious metals allows you to diversify your portfolio and can set you up for future financial success. Gold, silver, and other precious metals are highly coveted around the world and easy to liquidate if you decide you want to cash in on your investment.

However, this doesn't mean you should just purchase precious metals from any company. With the many different companies out there, there is no reason not to take some time and thoroughly research your options to find the best choice.

While JM Bullion may sound appealing at first glance, after taking a closer look at reviews from past customers and review organizations, there seem to be some issues with service and quality. This is unacceptable when you're thinking about making a large investment in gold, silver, or other precious metals. We'd recommend looking for a different precious metals investment company.

Although we do think that JM Bullion is a decent company, we believe that there are better companies out there to make your investment with.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with JM Bullion...