The interest in gold IRAs has increased in recent years, following the economic turmoil of the COVID-19 pandemic and other global events. Every time the stock market dips, people wonder whether it's safer to put their money into other things. Precious metals are tangible, perform inversely to the stock market, and have retained their value for thousands of years.

Monetary Gold is one of dozens of companies that offer gold IRAs. There are account options available to people in every state in the US, but is it worth it? How do their services compare to other gold IRA companies? What should you know before you decide whether this is a good place to store your money?

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

About Monetary Gold

Monetary Gold operates as a precious metals dealership that sells gold and silver. They have a strong focus on gold IRAs, but also sell precious metals products for non-IRA investments. Some of their inventory products cannot be held in an IRA, so you have to buy them with cash instead.

This is one of the longer-running gold IRA companies in the industry. It wasn't until 1997 that Americans could legally tie up part of their retirement savings in gold. Even then, the legislation came with a lot of rules and regulations. Monetary Gold began its operations in the year 2000 and has continued to thrive in its California headquarters ever since.

In fact, nowadays Monetary Gold is among the biggest precious metals dealers in the entire country. Not only do they have a wealth of inventory products available for their clients, but they have also been listed as a Direct Dealer with the US Mint. This means that they are given the opportunity to buy freshly minted products directly from the US Mint in bulk, instead of needing to go to a middleman wholesaler.

The majority of Monetary Gold's offerings are some form of coins and bars. They mostly have gold and silver, but you'll also occasionally find limited platinum and palladium offerings. IRA-eligible platinum and palladium coins are rare, often consisting just of American Eagles. But there are a variety of IRA-eligible bars that come in different weights and sizes.

As for non-IRA products, Monetary Gold offers quite a few product categories that can't be stashed in your retirement account. For example, they have some foreign currency, semi-numismatic rarities, historic coins, and exclusive collections.

Semi-numismatic coins are not allowed in an IRA due to how they are priced. Unlike investment bullion, these coins are typically priced speculatively. There's an assumption that the coin may grow in value due to its rarity. As such, you might pay significantly more than the melt value, in the hopes that someone in the future will pay even more than that for the novelty.

While semi-numismatic coins are not always the safest choice for an investor, they do sometimes have more potential for growth. But it's important to make sure that you're aware of the risks of your investment, and that you diversify your portfolio accordingly.

Gold IRA Storage

The storage of a gold IRA is just as important as the products that you choose. According to the IRS, your account must be stored in a vault in an accredited depository. You have the choice of segregated or non-segregated storage. There are dozens of depositories both in the US and internationally that meet the security guidelines.

Some examples of the security measures are regular audits by third parties, 24/7 security, surveillance, and other fraud protections. Typically, these accounts will also all have full insurance policies against damage or natural disasters, which are covered by your annual fees.

Your custodian will maintain this account. They will be in charge of putting your products into the vault, checking the audits to make sure that the account statements are accurate, and updating you on the value of the holdings. In addition, they are the ones who file the important tax paperwork with the IRS regarding your retirement account.

Why Not Private Storage?

Monetary Gold says on their website that it is possible to store your gold IRA at home. While many people might prefer to do this for their own peace of mind, there are several reasons why it's not a good idea.

First, it's against IRS regulations. There is a legal loophole that you can use when filing your paperwork. You can create a self-directed IRA and put a shell company corporation into it. Then all of the assets held by the corporation will be considered a part of your retirement account. You'll put money into the corporation, use that money to buy precious metals directly, and store it at home.

But this is just a way of getting around IRS regulations. If they take notice of what you're doing, they could impose some hefty penalties. Then you'll end up needing to store your gold in a depository anyway. It's not worth the risk, especially since doing this could leave you under IRS scrutiny for a while afterward.

Second, your home storage isn't as secure as depository storage. Many people don't want to believe this, since you want to feel secure at home. You might also want to know that you can grab your metals if you need them in an emergency. But if that's the case, you should invest with cash, not with your retirement funds.

Depositories are much safer. They have more robust insurance policies and security. The entire property has been designed specifically to keep your items safe. The accounts all undergo frequent auditing to avoid fraud, and you can even get a segregated account if you're willing to pay extra. With this measure, no one can access your items at all except for you and your custodian.

By contrast, home storage might be damaged in a natural disaster or a fire. You're also more vulnerable to theft, even if you have a heavy duty safe. Not to mention that you won't get the ongoing reports about how much your precious metals are worth, or the ongoing audits to make sure that your account is accurately reflected.

If you work with Monetary Gold and buy their products with cash instead of your IRA funds, then having the package delivered to your home is fine. You can get a fully insured delivery for a flat fee of $30. Since there's an insurance policy on the package, you will need to sign for it at the door.

Delaware Depository

The other company that Monetary Gold most often works with for storage is the Delaware Depository. This is the biggest depository in the United States, a massive building that holds thousands of pounds of gold, silver, and other precious metals.

Delaware also has certain tax advantages. Unlike many of the states on the East Coast, there are no sales taxes or gold account taxes. You won't pay transaction taxes when you buy or sell gold. If your home state has a high sales tax, then the Delaware Depository might save you quite a bit of money.

Every account held with the Delaware Depository is insured with Lloyds of London, which is the biggest and richest insurance company in the world. They cover the accounts of many depositories internationally.

There are also the other security measures that you might expect. The vaults and the premises are monitored by cameras at all times. There are constantly security personnel on site, and you can even visit the facility to look at your precious metals. The staff just ask that you make an appointment first so that they're prepared to take you to your account. Make sure you have appropriate identification ready, too.

Is Monetary Gold a Scam?

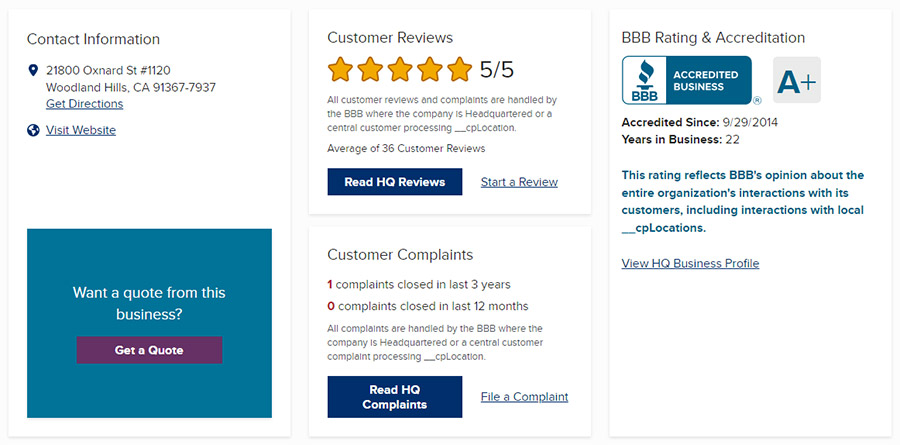

Monetary Gold doesn't seem to be a scam. Not only are there no scam reports online, but the company also has a very solid reputation. Many verified customers have written reviews indicating that they had a good experience.

The Better Business Bureau has verified the company and given them a coveted A+ rating. On Consumer Affairs, several dozen customer reviews show an average of 4.9 stars. There have not been complaints filed with the BBB over the past three years. Usually if a business is not trustworthy, it will be reflected in their BBB rating and reviews.

Monetary Gold has also received recognition in the industry by a variety of trusted third party organizations. Their IRA services have been praised by Retirement Living, and their overall customer service has been praised by Consumer Affairs.

Monetary Gold has been in the business since 2000, boasting well over two decades of experience in the industry. It's rare for a company to last this long if they don't have legitimate business practices. On top of this, they are actually a Direct Dealer for the US Mint.

That's a big deal because many companies are not able to receive coins directly from the US Mint. Instead, they have to buy them from wholesalers at an increased markup. Since Monetary Gold doesn't have to do that, they are more capable of giving customers prices closer to the spot value of the metals.

The employees at Monetary Gold appear to be proud of their A+ BBB rating, citing it several times on the website. On the rare occasions that there is any negative feedback, the company helps resolve it to the client's satisfaction immediately.

The only potential red flag is that Monetary Gold does not seem to have a publicly disclosed owner. But with that said, there are several employees and their job titles publicly searchable on Linkedin. We were able to find the IRA director. In addition, the office headquarters are in Westlake Village in California. Principal contact for the company is named as Ms. Andrea Powers.

Pros & Cons of Monetary Gold

Pros:

Cons:

Final Thoughts

There's no doubt that Monetary Gold is a legitimate business, and that they provide legitimate gold IRA services. Customers have written great reviews and mentioned how glad they are to work with the varying executives. Though there is no publicly listed company owner, several of the employees and corporate executives can be found easily through Linkedin. There is also a tangible company headquarters and a long business history.

The vast majority of online reviews about Monetary Gold are positive. They are trusted not just by consumers but also by people in the industry, having been designated as one of just a few Direct Dealers in the United States. Being a Direct Dealer means that they can connect customers to products at wholesale prices. They try to operate with a low overhead to increase the amount that customers save.

The educational tools are also impressive. Not only do they have free guides and articles available to read, but they also have free online workshops that you can sign up for. Only a few other companies offer such services. You can work one on one with one of the executives to have your questions answered and decide whether precious metals investing is right for you.

However, there are a few companies that we would recommend more highly. We especially don't recommend using a home storage IRA through Monetary Gold. There are legal loopholes that can be used to do this, but it's a bad idea. The IRS has not looked kindly on this in the past, and you could end up paying some pretty hefty tax penalties if you do.

Don't forget to check out our top recommended companies before investing!