Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Are you counting down the years until you are able to retire and start truly enjoying your life? Do you work hard every day and save as much money as you can but still wonder if you'll have enough to do everything you'd like to when you retire? If you have some of your money invested in the stock market, you're off to a good start.

However, the stock market is known for its ups and downs, and having all of your money invested in one place can be a recipe for disaster. Rather than leaving all of your money invested in stocks and bonds, consider investing some of it in gold, silver or other precious metals. Whether you choose to set up a Gold IRA or simply purchase some coins and bars for a personal investment, when some of your money is held in precious metals, you'll be more protected against a potential stock market crash.

Birch Gold Group is a well-known name with those familiar with investing in precious metals. If you've been thinking about finding the right company to help you diversify your portfolio, you may be impressed by all they have to offer. Continue reading and we'll highlight some of the benefits of choosing to work with Birch Gold Group as well as the various coins and bars they have available for their investors.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Birch Gold Group made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Is Investing Precious Metals a Good Idea?

If you've been wondering whether investing in precious metals is the right financial move for you, there are a number of compelling reasons to invest. First, gold, silver, platinum, and palladium are rare and in high demand worldwide. This just works to drive their value up as people look to purchase them for jewelry, housewares, and so much more.

Many people don't realize that precious metals are also used in new technologies. This is especially true for silver, and should give investors confidence that as we make even more technological advancements, the demand for precious metals will only continue to increase.

Unlike some other investment options, such as real estate, precious metals are extremely easy to liquidate. Because of the high demand for these metals, should you decide to sell your investments for cash, you shouldn't have trouble finding an interested buyer.

When you purchase precious metals, you are also diversifying your portfolio. Holding some of your investments as precious metals and some as stocks and bonds helps you keep a more balanced portfolio that will protect you from stock market volatility.

What is Birch Gold Group?

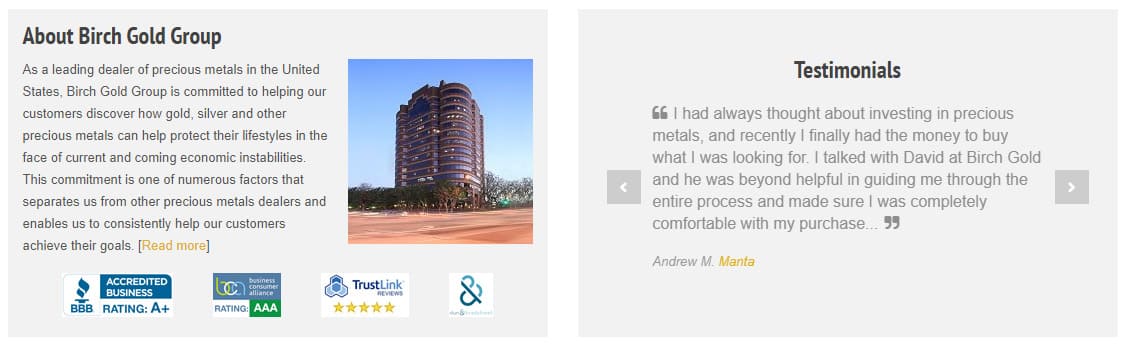

Birch Gold Group has been in the gold investment industry for nearly two decades. Since the company first started in 2003, they have grown to be a top precious metal dealer and a trusted name. The company's headquarters are located in Burbank, California.

Birch Gold Group has earned high reviews from precious customers as well as review agencies. You can view some of the reviews from satisfied customers on Google, Trustpilot, Facebook, and other review sites. The Better Business Bureau and the Business Consumer Alliance both awarded Birch Gold Group their highest reviews (A+ and Triple A, respectively).

As you learn more about Birch Gold Group and how the company operates, it shouldn't be surprising to hear how highly rated they are among customers and review agencies. The team at Birch Gold Group always puts the customer first. They are dedicated to making sure each of their clients get the attention needed to help them reach their financials goals.

Each member of the team is experienced and ready to offer investing advice to help their clients set up new IRA accounts, choose which precious metals in invest in, and more. They are also receptive and willing to help answer any questions my might have.

When you visit Birch Gold Groups website, you can read more about the standards that outline the company's philosophy and priorities. These standards are:

Many of these standards are definitely lacking from other less reputable gold investment companies. If you've ever worked with another precious metals company, you should feel the difference on that first call with a member of the Birch Gold Group team.

If you've ever listened to the Ben Shapiro Show, you may have heard a member of Birch Gold Group's team sharing investment advice or other information. They are regularly asked to be on the show to share their expertise and help listeners make the best financial decisions they can to build wealth and secure a successful future.

Opening a Precious Metals IRA

One of the most popular ways in invest in gold, silver, and other precious metals is to open a Precious Metals IRA. A Precious Metals IRA is a form of a Self-Directed IRA where individuals are allowed to hold assets other than stocks and bonds in a retirement account. Precious Metals IRA holder enjoy many of the same tax advantages as traditional IRA holders, making them an appealing way to save for retirement.

Opening a Precious Metals IRA with Birch Gold Group will also help you diversify your portfolio and offer yourself some protection against stock market volatility. Birch Gold Group can help individuals open a new Precious Metals IRA or rollover an existing retirement account into a Precious Metals IRA.

Whichever option you choose, you'll be able to contribute up to $6,000 each year ($7,000 if you're over 50). This is the maximum combined contribution, so if you have another IRA, keep this in mind so you won't face any penalties from the IRS.

If you're interested in opening a new Precious Metals IRA, you can start the process right on Birch Gold Group's website. Just send a message to a member of the Birch Gold Group through the 'Contact Us' page on the website. If you'd prefer to start with a conversation with a life person, you can also call the toll-free 800 number listed on the site.

The representative you work with will assist you in setting up a transfer from your bank account to fund your new IRA. Once the transfer is complete, you can select the coins and bars you wish to add to your account.

If you already have an IRA or other retirement plan, it may be eligible for a rollover into a Precious Metals IRA. Some account types that may be eligible include 401(k)s, 403(b)s, 457s, traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and TSPs. However, different circumstances impact eligibility, so work with a member of the Birch Gold Group to determine whether your specific plan is indeed eligible.

If your existing retirement account is eligible, and you'd like to proceed with the rollover, the Birch Gold Group representative will assist you through the process to make sure the funds are transferred correctly and all the necessary paper is properly filled out. Since you face the potential for IRS fees and penalties if a transfer or rollover isn't completed properly, it is nice knowing you're working with an experienced member of the Birch Gold Group team.

Birch Gold Group connects their clients with an IRA custodian to oversee the transfer of funds. They only work with companies with an A+ rating from the Better Business Bureau, including STRATA Trust and Equity Trust.

Once the transfer is complete and the funds are in your new account, you can choose which gold, silver, platinum, or palladium coins and bars you'd like to add to your account. Again, the member of the Birch Gold Team you've been working with can serve as a great resource if you're unsure just which pieces you'd like to invest in. They can offer advice to help you balance your portfolio with precious metals that will help you achieve your goals.

Approved Coins and Bars for IRAs

The IRS tax code lays out specific criteria that precious metals must meet in order to be held in an IRA. Coins and bars must meet a set purity level, which varies across different types of precious metals. Here are the purity levels for each type of precious metal:

Birch Gold Group offers a large selection of IRA-approved gold, silver, platinum, and palladium coins and bars. Below are the various coins you can choose from to add to your new Precious Metals IRA.

Gold

Silver

Platinum

Palladium

Precious Metals IRA Storage

When you're making a large investment in anything, you want to be able to rest easy knowing your investment is safe. When you purchase precious metals for an IRA, you can do just that. All precious metals purchased for IRAs must be stored in an IRS-approved depository, per IRS regulations.

There are two different IRS-approved depositories you can choose from when you work with Birch Gold Group. The custodian helping you with setting up your account can help you to determine which depository is ideal for your needs, but really you can't go wrong with either choice.

The first option is to store your precious metals with Brink's Global Services. When most people hear 'Brink's' they think security, and this definitely rings true for their storage facilities. There are over 1,000 Brinks Global Services storage locations around the world.

Each of these facilities features top-notch security to ensure your precious metals stay safe. Your precious metals will also be insured and protected in the facility, so there is nothing to worry about should you choose to store with Brink's Global Services. In fact, they are so well-known for security that many governments, banks, and jewelers turn to Brink's Global Services when they have something valuable that requires secure storage.

When your precious metals are on their way to the Brink's Global Services storage facility, they will also be fully insured and protected. Brink's will cover any damages or replacements, should any be necessary.

The other storage location you can choose to use is the highly secure Delaware Depository. This is one of the most-trusted storage locations for precious metals. There are two different Delaware Depository locations to choose from: Wilmington, Delaware and Seal Beach, California.

Each of these locations lives up to the highest standards of security. Your precious metals are kept separate from others and are fully-insured. During transit to the Depository, $100,000 in insurance protects your investments. Everything is also thoroughly inspected and verified upon arrival to provide you with additional peace of mind.

Additional Opportunities to Invest in Precious Metals

You can also purchase precious metals for investment in addition to setting up a Precious Metals IRA. This will allow you to further diversify your portfolio and take greater advantage of the benefits associated with investing in precious metals.

When you purchase precious metals for a personal investment, you aren't limited by the regulations the IRS places on adding precious metals to an IRA. This means that you can take possession of your metals right away and store them wherever you'd like. It also means that you'll be able to choose from a wider selection of coins since the same purity requirements don't apply for a personal purchase outside of an IRA account.

You can purchase any of the IRA-approved coins or bars shared above for a personal investment, and Birch Gold Group also offers a few other options for investors. These include:

Gold

Silver

Free Precious Metals Information Guide

Investing in precious metals can be a good financial move for most people. However, if you still aren't completely sure you're ready to begin investing or have a few more unanswered questions, take advantage of the free precious metals investor kit that Birch Gold Group offers.

In the kit, you can find more in-depth information about investing in precious metals and setting up a Precious Metals IRA. The various gold, silver, platinum, and palladium coins and bars offered by Birch Gold Group are also featured in the guide to help you decide which pieces you would like to purchase.

Useful Resources for Investors

As we shared above, one of Birch Gold Group's standards for their company is education. The representatives can be a good resource to answer questions and share additional information with you, but you'll also find a plethora of additional resources located right on the website. When you have some time, be sure to take a look at all of the resources they offer to help you learn more about the benefits of investing in precious metals, retirement implications, and more.

One of the headings on the website is 'Education,' and when you hover over it, you'll see the various categories where you can locate more information. These categories include "Why Precious Metals?" "How to Purchase," "Free Info Kit," "Interactive Prices," "Interviews," "Physical vs 'Paper' Gold," "Your Financial Advisor and Gold," and "Spotlight on Proof American Eagles."

Under the "Interviews" section, you can listen to interviews the company conducted with reputable individuals in the financial industry. Some of the interviews available to listen to include Steve Forbes, Peter Schiff, Doug Casey, Floyd Brown, and Jim Rogers.

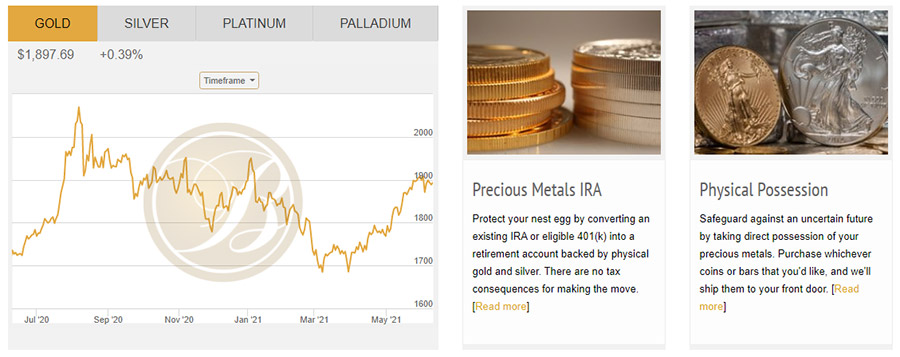

Another resource we found helpful is the "Interactive Prices." In this section you can view the current price of gold, silver, platinum, and palladium, as well as the change in the price over a set timeframe (you can choose from 1 month, 3 months, 6 months, or 1 year).

Features

Pros:

Cons:

Final Verdict

Birch Gold Group is an excellent company to work with if you'd like to set up a new Precious Metals IRA, rollover a retirement plan, or purchase gold, silver, platinum, or palladium coins for a personal investment. Once you've made the decision to invest in precious metals with Birch Gold Group, you should be able to rest easy knowing you selected a highly trusted company and that your investment portfolio will be diversified to protect you against future stock market drops.