Do you look at everything going on in the world and worry about your future? Are you concerned that you might not be able to retire comfortably as soon as you had hoped? Many people share these same concerns, and some of them are doing something about it by opening a Gold IRA.

Gold Alliance is one of the many Gold IRA companies that you could choose to work with when you're ready to get your portfolio diversified by investing in gold, silver, or other precious metals. Are they the best company for you to choose? That's the question that we’re going to help you answer in the article.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

About Gold Alliance

Gold Alliance has over two decades of experience in the precious metals industry. When the company was founded in 2002, they set their vision to help their customers invest in precious metals to diversify their portfolios and make sure that they have what they need to retire when desired. They strive to educate each client, helping them learn more about the benefits of precious metals and how they can help them achieve their financial goals. They want each customer to be empowered to make the best financial decisions.

Gold Alliance has earned top ratings from both the Business Consumer Alliance and the Better Business Bureau. These high marks (AAA and A+, respectively), speak to the level of customer service the company provides and can help give you an idea of how you’ll be treated as a customer.

You may have heard about Gold Alliance on the news, on the radio, or online. The company has been featured on Yahoo! Finance, the International Business Times, Fox News, Cision PR Newswire, Forbes, The San Francisco Examiner, and more. They have also earned the endorsement of Mike Huckabee.

Why Should You Invest in Gold?

If you’re reading this article, you’re probably already aware of several of the reasons you should consider investing in precious metals. They have been seen as a sign of prosperity for centuries. To this day, they continue to be highly treasured and in high-demand across the globe. However, because their supply is limited, their value is likely to continue to increase.

Another reason to consider investing in gold and other precious metals is that they are easy to liquidate for fast cash. Once you retire and are ready to start taking funds from your account, it won’t take much time at all to find a buyer for your precious metals, meaning that you’ll get the cash quickly. When you compare this to how quickly you’ll be able to see some other alternative investments, such as real estate, it should be very clear why some investors choose precious metals over (or at least in addition to) real estate investments.

The value of gold is not tied to the value of the dollar. This allows it to serve as a good hedge against inflation. During these uncertain times, this can be an extremely compelling reason to consider investing in precious metals.

Finally, don’t forget about the value of having a diverse portfolio. Holding all of your funds in the stock market is risky. If the market significantly drops, can you imagine what that will do to your net worth? Do you think the plans you have started making for retirement would still be able to happen as scheduled? However, if you invest a portion of your portfolio in precious metals, you won’t have to worry quite as much about market dips. The precious metals will provide a buffer against a stock market crash, lessening the impact on your portfolio as a whole.

Gold Alliance Gold IRAs

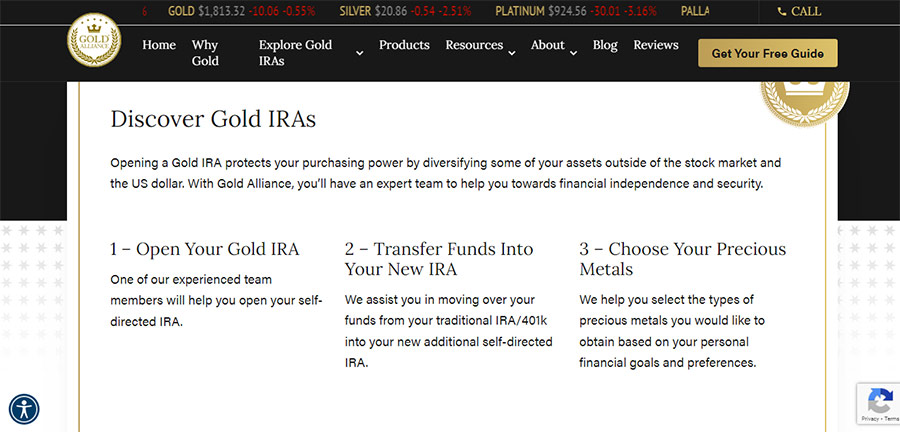

If you’re looking to invest in precious metals, one of the best ways to do so is to add them to an IRA. A Gold IRA (also called a Precious Metals IRA) is a type of Self-Directed IRA that allows you to do precisely that. As with Traditional and Roth IRAs, the tax laws in place for Gold IRA holders are very favorable, which can help you maximize the growth of your investments and make sure that you’ll have what you need when you’re ready to retire.

To open a Gold IRA, you must with a company that specializes in precious metals, such as Gold Alliance. The representative you work with from Gold Alliance will also help you find a Gold IRA custodian who can assist with transferring the funds from an old account to your new IRA.

Gold Alliance wants to keep this as straightforward as possible for their customers. Rather than having tons of confusing steps for you to complete in order to get your new Gold IRA opened, they have broken the process down into just three steps.

The first thing you’ll need to do is work with the Gold IRA custodian to open up your new Self-Directed, Gold IRA account. Once opened, the IRA custodian will also help you fund the account. You can transfer funds from an eligible existing retirement account. The transfer process takes a few days. After the funds have made their way to Gold Alliance, you can choose which precious metals you want to add to your account.

A Senior Portfolio Manager from Gold Alliance will be available to help you address any questions or concerns as you move through the entire account setup process. They will also help make sure that all of the paperwork is completed correctly. Basically, their job is to take as much of the work off of your plate to make everything as easy as possible for you.

Precious Metals for IRAs

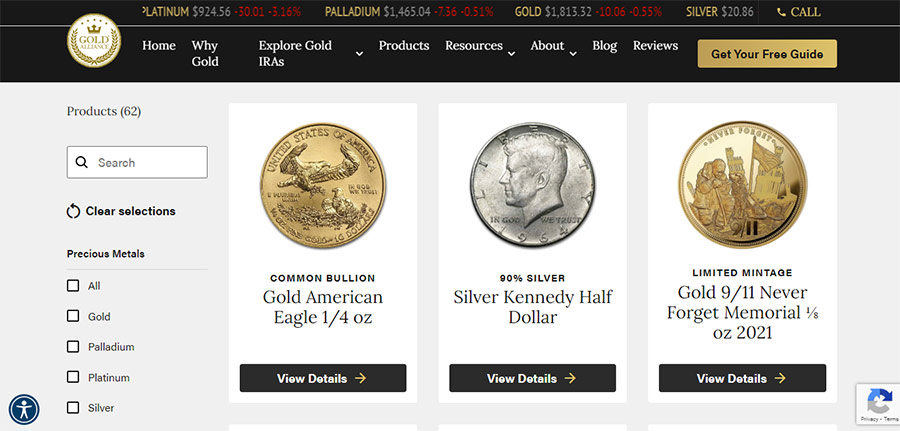

One important part of the Gold IRA setup process is deciding which precious metals you wish to add to your account. Gold Alliance customers can choose from a selection of gold, silver, platinum, and palladium products. This is actually one of the advantages of working with Gold Alliance, since many other companies only offer gold and silver, not palladium and platinum.

Based on the regulations established by the IRS, there are limits on the bars and coins you’ll be able to add to your account. Each bar or coin must meet a minimum purity requirement, which varies for each different type of metal. Platinum and palladium products are required to have the highest purity levels of 99.95%. Silver bars and coins need to be a minimum of 99.9% pure, and Gold must be at least 99.5% pure. There is just one exception to this requirement, and that is the American Gold Eagle Coin. Even though it is only 91.67% pure, it is still authorized by the IRS to be held in Gold IRAs.

As you’ll see in the next few sections, Gold Alliance offers a range of bars and coins to meet the purity requirements set forth by the IRS. Continue reading to see some of the different gold, silver, platinum, or palladium coins you can add to your account.

Gold

Silver

Platinum

Palladium

Gold IRA Storage

As you’re probably already learning, the IRS has some pretty strict rules regarding Gold IRAs. One of these rules is that you are not allowed to act as the custodian for your own precious metals. This means that you may not store the gold, silver, palladium, or platinum for your IRA in your own home. Rather, these metals are required to be stored in an IRA-approved depository.

There are several depositories across the country, and you could potentially to choose to have your metals stored in any one of them. However, Gold Alliance recommends the Delaware Depository to their clients. Located in Wilmington, Delaware, this depository has an exception reputation. In addition to the multiple layers of security in place to protect your precious metals, a comprehensive insurance policy adds yet another layer of confidence that your metals will be ready when you want them. This insurance policy is underwritten by London Underwriters, another trusted name in the industry.

Making Yearly Contributions to Your Gold IRA

Once your IRA is set up, you can continue making contributions to it each year. The IRS just recently raised the maximum contribution limit to $6,500 (it used to be $6,000) for anyone younger than 50 years old. Any individuals 50 and older are allowed to contribute a bit more each year, for a total of up to $7,500.

This is the total that you are allowed to contribute to any IRAs you have. This means that if you have multiple IRAs, you will need to split your $6,500 (or $7,500) contributions between the two (or more) accounts.

Other Ways to Invest

Opening a Gold IRA is just one of the ways that you can invest in precious metals with Gold Alliance. The other option you have is to purchase precious metals as a personal investment. When you buy gold, silver, platinum, or palladium as a personal investment, you have more flexible storage options. Because they are not in a Gold IRA, you can store the metals wherever you’d like, whether in your home, a bank vault, or a depository.

Another benefit of purchasing precious metals outside of an IRA is that you also won’t be limited by the purity requirements outlined by the IRS. You can purchase any of the IRA-approved metals listed above, but you can also invest in some rare and collectible coins that fall short of the IRS’ purity requirements. Some of these more collectible and historic pieces available through Gold Alliance include:

Gold

Silver

Resources for Investors

If you’re new to investing in precious metals, you may still have some questions or want to learn more. Gold Alliance offers a “Resources” section on their website. In this section, you can consult some FAQs about gold and silver, learn more about the benefits of holding precious metals in your portfolio, and read through featured news articles. Precious metals price charts showing the performance of gold, silver, platinum, and palladium are also included in this section. You can adjust the charts to show a set time range, from just a few days to up to more than10 years.

Features

Pros:

Cons:

Final Verdict

With over two decades of experience, Gold Alliance is a trusted source in the precious metals industry. They offer several gold, silver, platinum, and palladium bars and coins that you can add to a Gold IRA to help you make sure you’re ready for retirement. Before making a final decision about whether Gold Alliance is the right company for you, though, remember that there are several other precious metals providers out there. Take a little time to really compare the options available to you to help you decide which company offers the best fit for your needs and expectations.

Don't forget to check out our top recommended companies before investing!