Now is a stressful time to be thinking about your retirement years. Whether you’re still several decades away from being able to retire or are quickly approaching your time, watching the volatile stock market can be quite disheartening. If you’re concerned about the value of your investments and are looking for a way to make sure that you’re ready to retire, then now may be the perfect time to look into opening a Gold IRA.

Gold IRAs offer the special opportunity to invest in precious metals within your retirement account. This means that you not only benefit from a more diversified portfolio, but that you’re also able to receive the favorable tax laws that come with IRAs. With so many different Gold IRA companies out there, we understand how challenging it can be to know who to work with. We’ve put together this review of JM Bullion to help you learn more about the company and decide if working with them is the right choice for you.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

About JM Bullion

Since 2011, JM Bullion has been a top name in the precious metals industry. Today, they have been ranked on the Inc. 5,000 as one of the fastest growing precious metals companies. The company prides itself in the customer service they offer to each client. In fact, in 2017, they were awarded a Gold Stevie Award recognizing their exceptional customer service department.

JM Bullion is an accredited business with the Better Business Bureau and has earned their highest rating of A+. They also have positive customer reviews with over a 4-star average on sites such as Trustpilot and Facebook.

Why Work with JM Bullion to Set Up a Gold IRA?

Friends, family members, media personnel, and other individuals may have told you that you should open a Gold IRA. However, do you really understand why you should be considering this investment decision? There are actually a wide range of reasons to consider investing in precious metals, particularly through an IRA account. Let’s take a look at a few of these reasons.

First, you will be able to create a more diversified portfolio, which will set you up to be in a better position should the stock market take a beating. Because a portion of your money will be held in precious metals, the effects of a market crash won’t be as catastrophic. Moreover, gold and other precious metals are rare. They are also highly coveted across the world. These two facts combined makes it seem reasonable to predict that their value will continue to rise with a high demand and a low supply.

Setting up a Gold IRA also means that you’ll benefit from the IRS’ tax laws for retirement holders. One type of Gold IRA you can set up is a Traditional Gold IRA. With this type of account, you can deduct your contributions from your taxes. The funds you contribute to the account will continue to grow, tax-free, until you are ready to retire. You’ll only be taxed on your holdings once you’re old enough to retire and start making withdrawals from the account.

Another option you’ll have when investing in precious metals in a retirement account is to open a Roth Gold IRA. This account type works differently than a Traditional Gold IRA, but still offers tax advantages. The funds for this account type are taxed before they are added to the account. As such, your account will grow tax-free, and you won’t have to pay any additional taxes when you start taking disbursements after retiring.

The tax rules for Traditional and Roth Gold IRAs can help you decide which account type is best for you. Consider a Traditional IRA if you predict that you’ll be in a lower tax bracket when you retire. Think about opening a Roth Gold IRA if you believe that you’ll be in a higher bracket in the future.

Opening a Gold IRA through JM Bullion

One of the services JM Bullion offers is setting up Gold IRAs for their clients. When opening a Gold IRA, it is essential to also work with a Gold IRA custodian. They are the only ones who will be able to transfer the funds from your existing retirement account, and they will work to make sure that the money is transferred according to the IRS regulations. JM Bullion works with New Direction IRA, an A+ rated and accredited business with the Better Business Bureau.

JM Bullion knows that their clients have more important things to worry about than spending tons of time getting a Gold IRA set up. For this reason, they have taken steps to keep the process as quick and pain-free as possible. They have broken it down into just three steps:

Open the Gold (Self-Directed) IRA Account with a Self-Directed IRA custodian.

Fund the account either through a transfer of funds from an existing retirement account or a bank wire or money transfer from a personal account.

Work with JM Bullion to purchase precious metals (gold, silver, platinum, or palladium) coins and bars for your account.

IRA Approved Coins and Bars

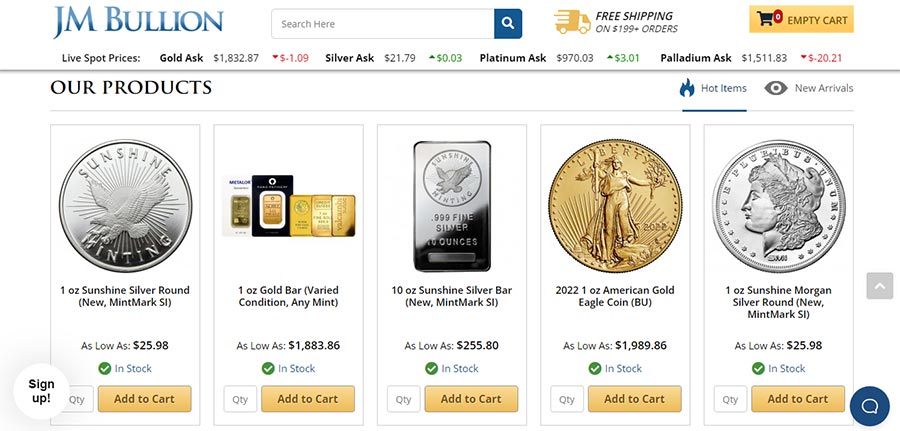

One of the best parts of opening a Gold IRA is picking out the coins and bars you want to hold in your account. Even though they are referred to as Gold IRAs, you can also call this type of account a Precious Metals IRA. Gold, silver, platinum, and palladium can all be held in your account.

However, due to regulations the IRS has established, you cannot simply add any gold, silver, palladium, or platinum bars or coins to an account. They must meet or exceed the purity specifications put in place by the IRS. This means that gold bars and coins need to be at least 99.5% pure, silver bars and coins must be at least 99.9% pure, and palladium and platinum bars and coins are required to be at least 99.95% pure.

Within these regulations, you’ll find that JM Bullion is still able to offer an assortment of different options for you to choose from. With so many different choices available, though, you may find it difficult to choose what you want to hold. Fortunately, the precious metals advisor that you’re working with from JM Bullion will be available to help you choose the bars and coins that best match your investment strategy and goals.

Below are just a few of the different coins and bars that you may find available through JM Bullion. Keep in mind that the specific selection may vary based on what is currently in stock.

Gold

Silver

Platinum

Palladium

Storage

When you open a Gold IRA, you are required to store the metals for your account in a depository that has been approved by the IRS. Individuals are not permitted to keep their metals at home or take possession of them before they are 59 ½ years old, the minimum age of requirement as set by the IRS. Failing to follow proper storage procedures could result in major fees and taxes, and it definitely isn’t something you want to mess around with.

JM Bullion recommends working with A-M Global Logistics, LLC when storing your precious metals. This IRS-approved depository has over 50 years of experience protecting investments. When you store your precious metals with them, you’ll be able to rest assured that they are secure and will be waiting for you once you’re ready to embark on your retirement journey. The facility is UL-certified, holds an all-risk insurance policy to cover your investment, and utilities advanced security measures to keep your metals safe and sound.

Other Reasons to Consider Working with JM Bullion

There are a few other reasons you might want to consider working with JM Bullion. When you add precious metals to your IRA, all orders over $199 will ship for free. This can make it easy to add a few new coins and bars throughout the year without worrying about needing to pay for shipping.

Another reason to think about working with JM Bullion is that you can also purchase gold, silver, platinum, and palladium coins and bars for a personal investment. This can help you to diversify your portfolio even more as you near the age of retirement, potentially putting you in a better financial position.

JM Bullion also does more than just sell precious metals. They will also purchase precious metals from those looking to cash out of their investment. JM Bullion has created a streamlined system to help individuals easily receive a quote and get the money for the sale as quick as possible. You’ll need to start by logging into your account and choosing which coins or bars you’re looking to sell. You’ll receive a quote for the metals and can decide whether you want to sell them for that price or not. If you accept the price, simply lock it in and follow the instructions from the company to package your precious metals and ship them. After JM Bullion receives your precious metals and verifies their value, payment will be sent to you.

JM Bullion also offers gold and silver loans. With this type of loan, you can borrow against the value of the gold and silver in your portfolio. The gold and silver will be the collateral for the loan, allowing you to receive access to cash to pay for home repairs, medical bills, special events like weddings, and more. If you think you might be interested in applying for a gold and silver loan, you can visit the “Loans” section of JM Bullion’s website. There is a button to click that will let you apply online. The application takes only a few minutes to complete, and no credit check is necessary. You should receive a response with information about the amount you are approved for and the interest rate within one business day. If approved, you could have the funding for your account within 10 days.

Features

Pros:

Cons:

Final Word

JM Bullion has a lot to offer their customers. However, they are not the only Gold IRA company out there. With so many different precious metals providers who offer Gold IRA services, you might want to consider looking around a bit more before making a final decision about who you want to work with.

Don't forget to check out our top recommended companies before investing!