Kingdom Trust is a company that offers self-directed IRAs. As an IRA custodian, they maintain your assets and help file all necessary reports with the IRS. But unfortunately, they don't have the best reputation in the industry.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

Fees and Pricing

When you establish your account, you will pay a flat fee of $50. Then there are annual fees based on the size of your account. These include a flat rate plus a certain percentage of your account's value. The more that you hold in your account, the higher the cost can add up.

The base annual payment for every account up to $1,000,000 in value is $195. If your account has less than $50,000 in it, then you'll be paying 0.0031% of the value of your assets. That percentage decreases as you move up in the rankings. By the time you reach $1,000,000 in holdings, you'll only pay 0.0018% of your asset value.

According to the Kingdom Trust website, the cost for maintaining any account over $1,000,000 is negotiable. It might depend on how the assets are allocated. You'll discuss the base price and whether to pay a percentage when you set up the account.

Is Kingdom Trust a Scam?

Kingdom Trust isn't a scam. The company is established and compliant with all regulatory oversight. Since they maintain retirement accounts and tax-advantaged accounts, they are strictly overseen by the federal government. It is very difficult to become a licensed financial institution if you're providing scam services.

Unfortunately, that doesn't mean that Kingdom Trust is a good company.

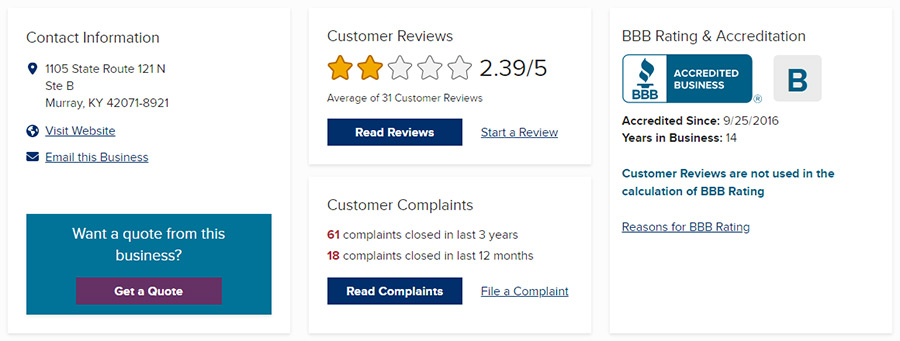

They have been accredited with the BBB. But instead of giving them an A+ rating, the BBB has given them a B. That's because of the absolutely enormous volume of complaints against the business. There have been 61 complaints in three years, 18 of which were filed in the last year alone.

That's about twice as many complaints as customer reviews on the website. And the customer reviews don't paint a better picture. While there are a few positive ones, the average star rating is 2.39/5. That shows that the vast majority of customers picked an extremely low rating when leaving their reviews.

Customer Complaints

There are so many complaints against Kingdom Trust that there's absolutely no way for us to address all of them. However, we can look at a few recent ones and see what the customers have to say. We'll also examine the company's responses to see whether they reacted appropriately and resolved the issue.

Some negative feedback is inevitable for any large company. But the ratio of complaints to regular reviews is already concerning. It might indicate that there are fundamental issues with the company's management, policies, or both.

Kingdom Trust has responded to every complaint filed against them. However, their BBB rating has still been lowered because of how many complaints there are.

Unexplained Charges

One customer left a complaint in August of 2022. In the complaint, she stated that she opened a self-directed IRA with Kingdom Trust in 2016. The account had not undergone any transactions whatsoever until 2020, when she used Kingdom Trust to buy cryptocurrency. The fees were charged as part of the purchase and were no surprise to the customer.

But two years later, in May of 2022, the customer's credit card was charged twice by Kingdom Trust. Both charges were for $400, less than two weeks apart. The customer called Kingdom Trust immediately to try to resolve the problem but was unable to get anyone on the phone.

Four days later, the customer finally got in touch with an account representative. It took several more calls before the customer was informed that she had been sent an email in February of 2022 regarding changing fees for cryptocurrency. The customer stated that she had not been sent this email.

Then in July of 2022, two months after the odd charges, the customer was given a personalized letter from Kingdom Trust's cryptocurrency subsidiary. The letter said that the trading fees had changed, but the cold storage fees were the same. The customer's cryptocurrency was in cold storage and had not been moved or traded.

The customer said that she was given a choice of three options for her account plan. In order to get a "free" no-fee option, she would need to surrender control over her cryptocurrency to Kingdom Trust. She said that the options were not suited to her, but her account representative flatly refused to remove any fees.

The customer was trying to close her account. But the company would not let her close the account until she signed a letter stating that she approved "willful misconduct" with regards to Kingdom Trust. The customer was not willing to sign this contract and wanted to have the matter resolved. Despite mailing paper letters, sending emails, and calling Kingdom Trust, she had not received any helpful response.

The company responded to say that there had been an initial error in the charging of the customer's account. She was meant to pay much more for cold storage than she had been. When the company's billing manager figured out the problem, an email was sent to the customer. The company stated that the customer was confused about the policies and the fees.

The customer stated that she was not satisfied with the response because she was not confused about the fees. She said that she would not be held liable for errors that were made by Kingdom Trust. When her contract with Kingdom Trust changed, she decided to liquidate her account. But Kingdom Trust was making the liquidation difficult. In addition, she reiterated that she had never received any correspondence about the fee changes.

Kingdom Trust never publicly responded again, so the matter still appears to be unresolved.

Gold and Silver IRA Issues

In August of 2022, a customer left a complaint specifically regarding his gold and silver IRA. They had made an investment with Kingdom Trust in October of the previous year. The customer stated that they were given an unsolicited phone call based on information they'd provided to one of Kingdom Trust's gold IRA partners, though they didn't remember doing so.

After the client had had several discussions with the company's representatives, they decided to liquidate their annuity and create a self-directed IRA. They wanted to use gold and silver due to the market, even though their accountant advised them not to.

The client transferred more than $77,000 into the new account with the expectation that it could double in value in between 3 and 5 years. Now, this is a fairly wild assumption. The gold industry tends to be fairly stable rather than exploding in growth, and most experts recommend that you don't liquidate your holdings for at least a decade afterward.

The shown value of the holdings the month after the switch was $77,000. But then in December, the following month, the value dropped to $45,000. That was a massive loss of nearly half of the investment value. When the customer called, he couldn't get any straight explanation about the loss. He still believed that the value might go up, so he kept his account active against his accountant's advice.

By January, the value had dropped to $30,000. The customer had taken a $300 distribution, but nothing even close to approaching the recorded loss. The account gained some slight value in March, going up to $32,000, before plunging back down to $29,000 in June.

June was the month that this client got in contact with Kingdom Trust and informed them that he needed a $19,000 distribution. But the people at Kingdom Trust convinced him that he should only invest $4,000 instead. Apparently the vice president of the company assured the client that his account was valued at $44,000. But the customer later learned that he had lost significantly more than that.

The company responded to say that there was confusion. They said that the customer had been dealing with their precious metals dealer, a separate company from Kingdom Trust. They recommended that the customer get in contact with their broker instead of looking for answers from their custodian.

While this does seem to be a reasonable response, it's odd for Kingdom Trust to do business with companies that appear to have unscrupulous business practices and unnecessary product markups.

Referral Program Problems

One complaint was written in July of 2022 with regards to the company's referral program. There is a program in place for current members with Kingdom Trust to refer other people. Both the referrer and the referee are supposed to receive a bonus of $50 worth of Bitcoin.

The program allows the bonus to be paid in two parts. First, the referee receives $20 for signing up. Then, when the account is properly funded, there's the additional $30. The client stated that he had referred his friend a few days prior, and the friend had funded his account.

Though both the client and his friend were given the $30 bonus, they never received the first $20. The client had had five conversations with different members of the company's customer service team, showing them screenshots of the inbox and their transactions.

Each time the customer did this, he was told that the support team had gotten in contact with the finance team. But it had been about a week without the client or his friend receiving the final $20. The client said that he had planned to invite other friends to use Kingdom Trust's services, but this experience had made him lose his trust in the company.

Kingdom Trust responded the day afterward to say that they had reviewed the accounts in question. When their IT team examined the situation, they found a glitch that was preventing the $20 reward from showing up in the customer's inbox. The client should now have messages informing him that he had received his full reward.

Closing an Account

One complaint from June of 2022 was from someone who was the beneficiary of their mother's IRA after she passed away. The client had been trying to get in contact with the company for weeks. Eventually, they received a communication asking them to provide the death certificate. The client emailed a copy and faxed one as well.

The customer was very unhappy about how long the process was taking and how difficult it was to get in contact with the company. Despite sending multiple emails and asking for a call back, no one had been in contact.

Kingdom Trust responded to say that they had received the documentation and sent the issue to a team leader to make sure it was resolved.

Pros & Cons of Kingdom Trust

Pros:

Cons:

Final Thoughts

Kingdom Trust is licensed to operate as a custodian for gold IRAs. They have assets under management for customers all over the US, and several customers use their services specifically for precious metals. But unfortunately, they aren't the best IRA custodian on the market. In fact, they have pretty terrible reviews.

Customers report that they've had trouble contacting anyone by phone or by email. They rarely get a call back even when they request it. Sometimes the support teams will promise that an issue will be resolved, but then the customer will go days without hearing anything more.

There have been so many complaints about Kingdom Trust's service that the BBB has downgraded their rating from an A+ to a B. To save yourself the headache and hassle, we recommend working with one of our favored gold IRA companies instead.

Don't forget to check out our top recommended companies before investing!