Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Lexi Capital is a gold IRA dealer that focuses on helping individual investors secure their assets in precious metals. They say that they want to give individuals the same power that hedge funds and big investment houses have. By educating clients about the risks and benefits of different ventures, they help people make the right choices for their futures.

That's what the company says, at least. But do they really provide all of the services they say they do? And are they good enough to compare to the best precious metals dealers on the market? Let's take a look and find out.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Lear Capital made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About Lexi Capital

Lexi Capital has been operating since 2010, so they have more than a decade of experience with the precious metals market. The founders are a pair of entrepreneurs that created the business plan for a UCLA class. Upon winning the first prize for their setup, they made an actual business from the plan.

The purpose of Lexi Capital is to give individuals a chance to invest in gold and silver. If you make the right choices, these assets can provide stability while having potential for growth. But investing can be a tricky process, especially if you're putting gold and silver into a retirement account.

Most individual investors aren't familiar with all the minutiae regarding self-directed IRAs. They don't know what paperwork needs to be filled out to set up an account, what regulations need to be monitored, or where to begin looking for someone to help. So Lexi Capital has become that company that can help.

With that said, Lexi Capital is far from the only company offering gold IRA services. There are several other dealers in the industry who will provide educational resources, good customer service, a streamlined account setup process, and high quality precious metals.

When you go to the Lexi Capital website, you can immediately see that it's set up somewhat differently from the competition. Competing companies often clutter their sites with endless information and downloads. Lexi Capital has a very simple site with minimal information displayed.

If you're looking for a company that publishes ongoing educational resources and in-depth articles, this might not be the one for you. But if you're a fan of a website that's easy to navigate and free of clutter, you might be happy with this option.

The Gold Assurance Plan

One of the most unique features that the company offers is their Gold Assurance Plan.

Gold and silver have been traded for thousands of years. Entire world economies have relied upon them in the past. There is a good deal of stability to a precious metals investment. But at the same time, the market price for precious metals fluctuates so often that you also risk a loss when you invest.

The Gold Assurance Plan is a price protection package that helps to secure your assets against sudden market downturns. If there are global or economic factors that affect the price of your metals, you can use this plan to recoup your losses.

The plan lasts for six months following your purchase. You get price protection at up to 500 dollars for every ounce of gold and silver you buy. That means that if the market value drops, you can recoup the lost value at up to 500 dollars.

The plan mainly applies to coins. However, if you want to cover your bullion products, you can pay an additional fee to have them covered by the Gold Assurance Plan as well.

Getting Started

Setting up a precious metals IRA is a relatively simple process thanks to Lexi Capital's streamlined setup.

To get started with your application, you can use an Express IRA form online or download an application for a self-directed IRA. If you already have an IRA, you can transfer the assets from that account into a new self-directed IRA.

Before you can purchase precious metals through the Lexi Capital dealership, you will need to fill out some personal information. You'll have to give your name, Social Security number, and any recent statements for your retirement accounts. This will prove that you have funds to transfer into your new IRA.

Once you've gone through the setup and identity verification process, you have the opportunity to select your investments. You can talk to an advisor about the different factors affecting the price of gold and silver. They will explain what investments work best for different growth and risk models.

You will have ultimate control over the investments you choose. You'll use the funds that you put into your new IRA. The company will package the metals and ship them to the IRS-approved depository you're using.

What to Know About Investing

Unlike precious metals dealers who offer rarer metals or alternative assets, Lexi Capital deals exclusively in gold and silver. Their product range is slightly limited, but it's well within the bounds of what most precious metals investors are looking for.

The reason that Lexi Capital focuses on gold and silver is because these are the most popular precious metals in the industry. They tend to have the highest demand from investors, which gives them the largest potential for growth. The goal is to help people get reliable and large returns on their investments.

Instead of acting as a regular broker, Lexi Capital specializes in the setup of precious metals IRAs. They help people fill out the paperwork to fund their gold IRA and work with a licensed custodian.

Since you'll be setting up a self-directed IRA, you can also hold assets other than precious metals. If you want to put real estate, stocks, trusts, promissory notes, or limited liability companies into your account, you can.

All of these different assets have different IRS regulations. Lexi Capital only specializes in the regulations regarding precious metals. So even though you can diversify your assets through the account you set up, the experts at the company will only help with the gold and silver.

The company website does not say whether Lexi Capital has partnered with any particular custodian. There is a customer review that states that the company works with STRATA Trust, which is a popular custodian for gold IRAs. If you have a custodian in mind, the company can presumably work with them.

To find out about the custodian options available to you, you can talk to a customer service representative. If the company is not partnered with any one entity, they may be able to give suggestions for choosing the best one for you.

Customer Service

Instead of ordering over the phone like with many other dealerships, Lexi Capital processes your orders through an online shopping cart. There aren't posted business hours associated with the customer service team, so there's no guarantee that you'll get an answer when you call.

The website does have a Contact Us link that will allow you to email the customer service department. If you call the telephone number and don't receive an answer, you can leave a message. Phone calls are returned anywhere from 24 to 48 hours after the message is left, while emails are typically answered more quickly.

If you decide that you want to cancel one of your orders, the company requests that you give them a call during the regular weekday business hours. It's not common for people to need to cancel their orders. If you do need to make a cancellation, you should be aware that you might have to wait up to two days for a response.

Fees and Other Costs

When you invest in a gold IRA, you will need to pay a maintenance fee to your custodian each year. You'll also need to pay annual fees to have your assets stored in a secure depository. Lexi Capital doesn't have control over these fees, as they vary depending on the custodian and depository you choose.

Some companies have partnerships with certain depositories and custodians already. This allows them to give you a transparent look at the potential fees. With this company, though, you'll just need to do independent research on depositories and custodians.

Most gold IRA companies have a minimum investment threshold to get an account set up. Lexi Capital's is one of the lowest in the industry. You only need to invest 1,500 dollars in their precious metals to get set up. It's common for other companies to require purchases of 5,000 to 10,000 dollars, or sometimes even more.

In addition, if you make an investment that totals at least 15,000 dollars, you will not need to pay any fees to set up your new account. The company will cover them.

There is a fee for cancelling your order. You'll need to pay a flat rate of 45 dollars, regardless of how much your order cost. Lexi Capital also states that they have a market loss policy. If the item has depreciated in value since you bought it, you will only receive the lower price as a refund.

Is Lexi Capital a Scam?

Lexi Capital is not a scam. The company operates legitimately and does everything they claim to do. In addition, they have relatively good ratings with third party websites and consumer watchdogs.

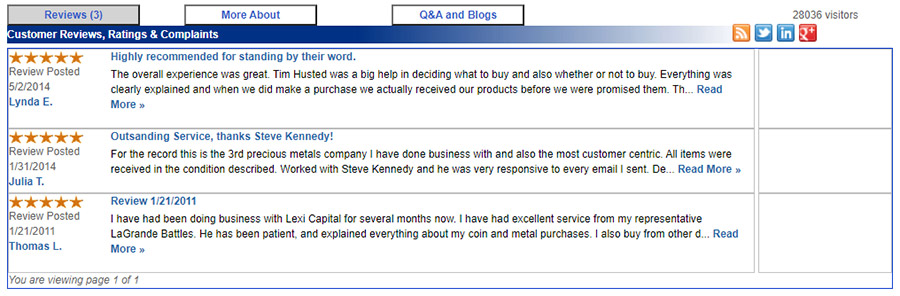

One thing to note is that there aren't a lot of customer reviews online. This makes it hard to find out about the experiences people have had with the company in the past. There are plenty of precious metals dealers that have hundreds or even thousands of credible customer reviews.

The lack of reviews isn't necessarily a red flag. It might just mean that the company works mostly with clients who stay offline. But if you want the most credible dealer for your investment, you'll want a company with a more well-established reputation.

Another potential issue is the lack of information on the website. You don't learn a lot about the company or your investment opportunities when you peruse their online presence. Again, that doesn't mean that the company isn't legit. But if you want more content, this won't be the ideal option for you.

When you look at customer reviews on Google, Trustlink, and Yelp, you can find people saying that they were given excellent customer service. The customer service representatives really seemed to care about making sure the investor was educated before making a decision.

There was one complaint regarding how long it took for the customer to get a call back. They were disgruntled that they couldn't place their order on the same day that they called. As mentioned, emails tend to have a faster turnaround than phone calls.

When you look at the Better Business Bureau website, you'll find that Lexi Capital has been accredited and maintains an A+ rating. The company also has excellent marks from the Business Consumer Alliance.

Pros & Cons of Lear Capital

Pros:

Cons:

Final Thoughts

Lexi Capital is a legitimate business that helps people get signed up for gold and silver IRAs. Instead of trading gold and silver regularly, they focus on providing retirement investment guidance. Every customer gets a high level of education regarding the risks and benefits of different options.

The thing that most sets the company apart is their price protection program. You have pricing protection for six months after a purchase, significantly longer than anywhere else in the industry. If your metals lose their market value, you can be reimbursed for losses of up to 500 dollars per ounce.

The company also has fairly good ratings and reviews online. There just aren't very many customer reviews, so it's hard to get a clear picture of what the management is like.

In addition, the company doesn't publish a lot of information on their website. Other gold and silver dealers are often bursting with articles, blogs, videos, and other information. But Lexi Capital doesn't seem to put a lot of work into their free educational resources.

All in all, there's nothing warning us away from this company. But there are other companies that offer similarly excellent customer service and similar IRA streamlining. Many of them have significantly more customer reviews, and they have a better overall reputation in the industry.

Although we do think that Lear Capital is a solid company, we believe that there are better companies out there to make your investment with.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with Lear Capital...